Volume Analysis Techniques

Volume analysis is a key component of technical analysis in trading and investing. By analyzing the volume of trading activity in a particular stock or market, traders can gain valuable insights into the strength and direction of price movements. In this article, we will explore some of the most commonly used volume analysis techniques.

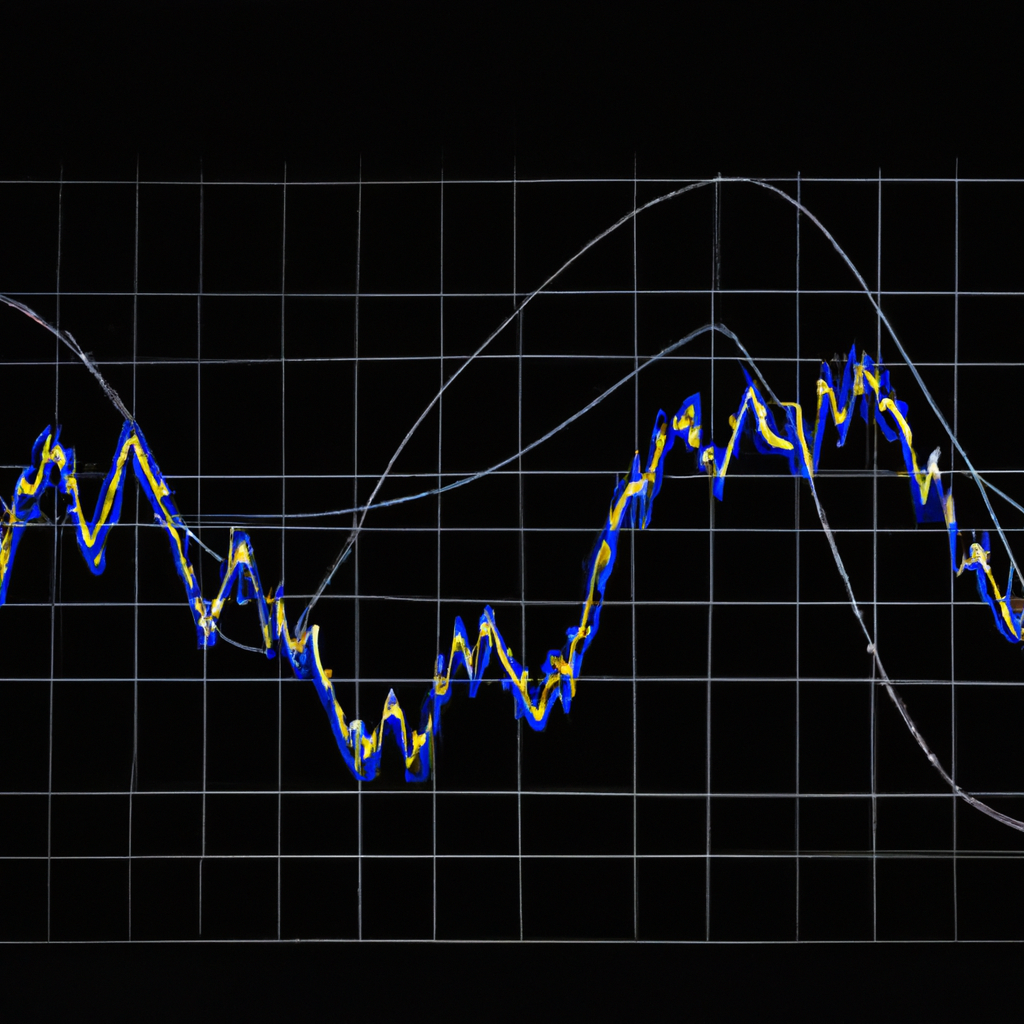

1. Volume Bars

One of the simplest volume analysis techniques is to look at volume bars on a price chart. Volume bars represent the number of shares or contracts traded during a specific time period, such as a day or an hour. By comparing the volume bars to price movements, traders can identify patterns and trends that may indicate buying or selling pressure.

2. Volume Oscillators

Volume oscillators are technical indicators that use volume data to generate signals about the strength of a price trend. One popular volume oscillator is the On-Balance Volume (OBV) indicator, which adds or subtracts the volume of trading activity based on whether the price closes higher or lower than the previous day. Traders can use volume oscillators to confirm price movements and identify potential trend reversals.

3. Volume Profile

Volume profile is a charting technique that displays the volume of trading activity at different price levels. By analyzing the volume profile, traders can identify areas of support and resistance where significant buying or selling pressure may be concentrated. This can help traders make more informed decisions about entry and exit points for trades.

4. Volume Divergence

Volume divergence occurs when the volume of trading activity does not confirm the direction of price movements. For example, if the price of a stock is rising but the volume is decreasing, this may indicate that the price movement is not sustainable and could be due for a reversal. Traders can use volume divergence to anticipate potential changes in market direction.

5. Cumulative Volume

Cumulative volume is a running total of the volume of trading activity over a specific time period. By tracking cumulative volume, traders can identify trends in buying and selling pressure that may not be apparent from individual volume bars. Cumulative volume can help traders gauge the overall strength of a price trend and make more informed trading decisions.

By incorporating volume analysis techniques into their trading strategies, traders can gain a deeper understanding of market dynamics and make more informed decisions about when to enter or exit trades. Whether using volume bars, volume oscillators, volume profile, volume divergence, or cumulative volume, volume analysis can provide valuable insights into market trends and help traders achieve greater success in the financial markets.