Understanding Support and Resistance Levels

Support and resistance levels are key concepts in technical analysis that help traders and investors identify potential entry and exit points in the market. These levels are based on the idea that the market tends to react at certain price levels, creating barriers that can act as support or resistance.

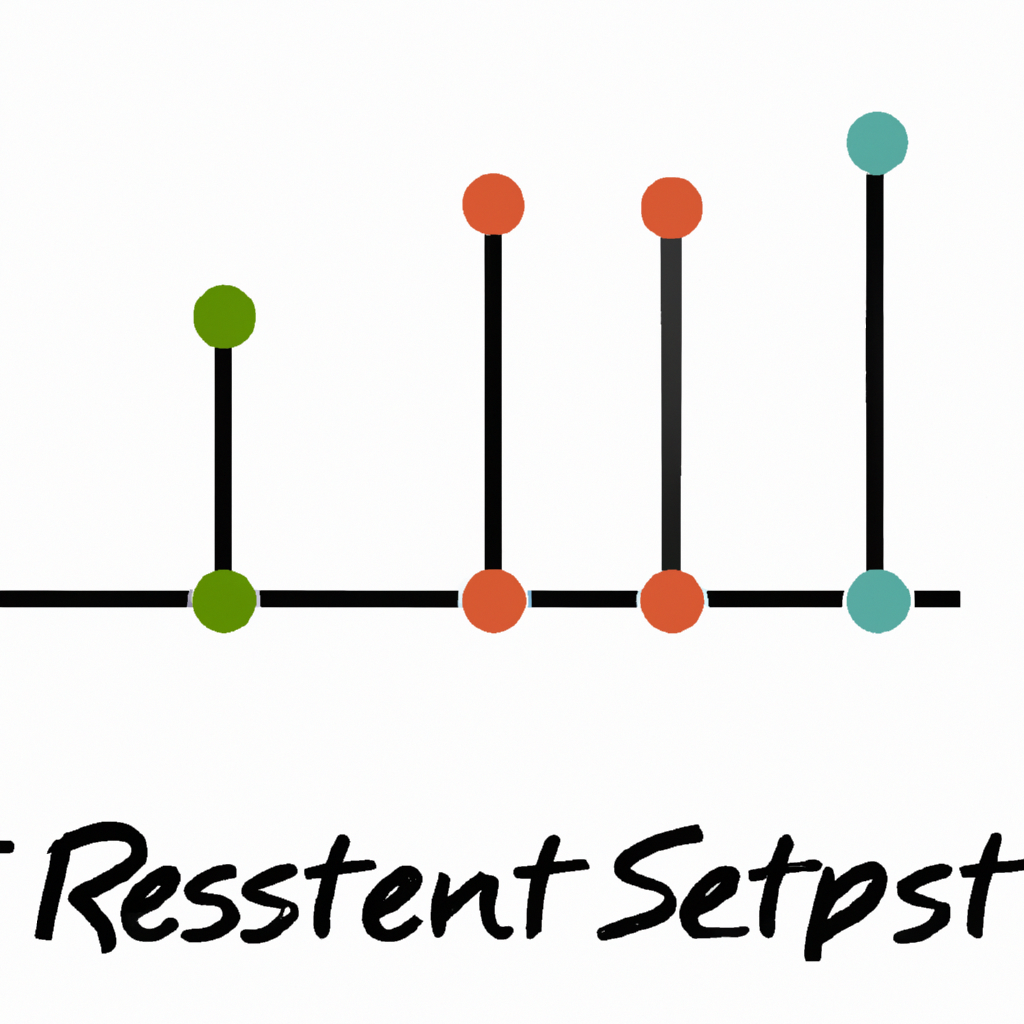

Support Level

A support level is a price level where a stock or market has difficulty falling below. It is a point where buying interest is strong enough to overcome selling pressure, causing the price to bounce back up. Support levels are typically seen as floors that prevent the price from falling further.

Traders often look for support levels to place buy orders or to set stop-loss orders to protect their positions. When a stock approaches a support level, it may present a buying opportunity as the price is likely to bounce back up from that level.

Resistance Level

A resistance level is a price level where a stock or market has difficulty breaking above. It is a point where selling interest is strong enough to overcome buying pressure, causing the price to reverse and move lower. Resistance levels are seen as ceilings that prevent the price from rising further.

Traders often look for resistance levels to place sell orders or to take profits on their positions. When a stock approaches a resistance level, it may present a selling opportunity as the price is likely to reverse and move lower from that level.

Identifying Support and Resistance Levels

Support and resistance levels can be identified using various technical analysis tools such as trend lines, moving averages, and chart patterns. Traders can also use historical price data to identify key levels where the price has previously bounced or reversed.

Support and resistance levels are not fixed and can change over time as market conditions evolve. It is important for traders to regularly monitor these levels and adjust their trading strategies accordingly.

Using Support and Resistance Levels in Trading

Support and resistance levels can be used in various trading strategies, such as trend following, range trading, and breakout trading. Traders can use these levels to set entry and exit points, as well as to manage risk by placing stop-loss orders.

By understanding and utilizing support and resistance levels, traders can improve their trading performance and increase their chances of success in the market. These levels act as valuable tools that help traders make informed decisions and navigate the complexities of the financial markets.

Overall, support and resistance levels are essential concepts that every trader should be familiar with. By incorporating these levels into their trading strategies, traders can enhance their trading skills and achieve better results in the market.