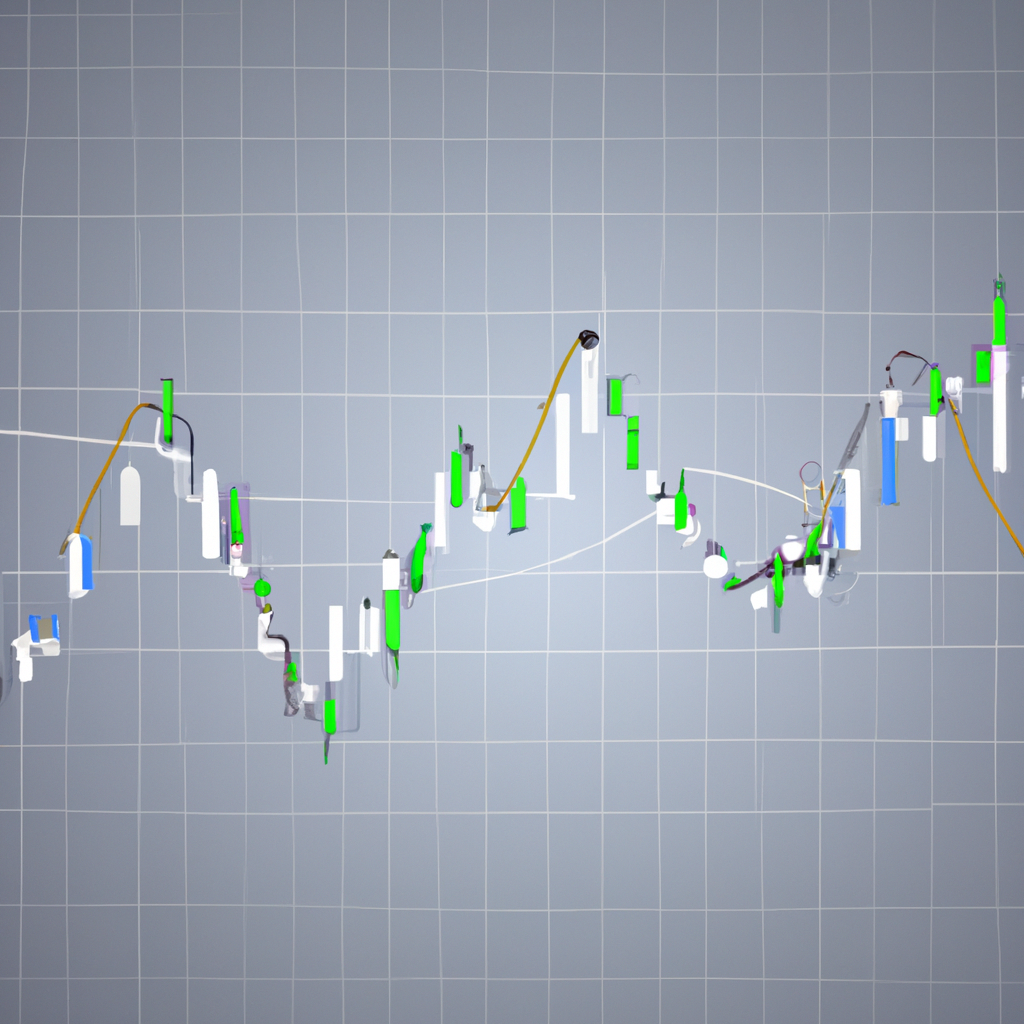

Harmonic Patterns in Trading

Introduction

Harmonic patterns are a type of technical analysis used by traders to predict potential price movements in the financial markets. These patterns are based on mathematical ratios and are believed to represent natural harmonic movements in the market.

Types of Harmonic Patterns

1. Gartley Pattern

The Gartley pattern is one of the most common harmonic patterns and is formed by a series of retracements and extensions. It consists of five points – X, A, B, C, and D – and is used to identify potential reversal points in the market.

2. Butterfly Pattern

The butterfly pattern is another popular harmonic pattern that is similar to the Gartley pattern but has different Fibonacci ratios. It is also used to predict potential reversal points in the market.

3. Bat Pattern

The bat pattern is a variation of the Gartley pattern and is used to identify potential trend reversals. It consists of five points and is based on specific Fibonacci ratios.

How to Trade Harmonic Patterns

1. Identify the Pattern

The first step in trading harmonic patterns is to identify the pattern on the price chart. This can be done using technical analysis tools and Fibonacci retracement levels.

2. Wait for Confirmation

Once the pattern has been identified, traders should wait for confirmation before entering a trade. This can be in the form of a candlestick pattern or a technical indicator signal.

3. Set Stop Loss and Take Profit Levels

It is important to set stop loss and take profit levels when trading harmonic patterns to manage risk. Stop loss orders can help limit losses in case the trade goes against you, while take profit levels can help lock in profits.

4. Monitor the Trade

After entering a trade based on a harmonic pattern, it is important to monitor the trade closely and adjust stop loss and take profit levels as needed. This can help maximize profits and minimize losses.

Conclusion

Harmonic patterns are a powerful tool for traders to predict potential price movements in the financial markets. By understanding and trading these patterns effectively, traders can improve their trading success and profitability.