Comparison of Trading Platform Security

Navigating the vast ocean of trading platforms available today can be daunting, especially when it comes to the paramount aspect of security. In an era where digital financial transactions are commonplace, the security of these platforms is crucial for protecting users’ assets and personal information. This article provides a comparative analysis focusing on the pivotal security features of various leading trading platforms, aiming to offer insights that could guide users in making informed decisions.

Introduction to Trading Platform Security

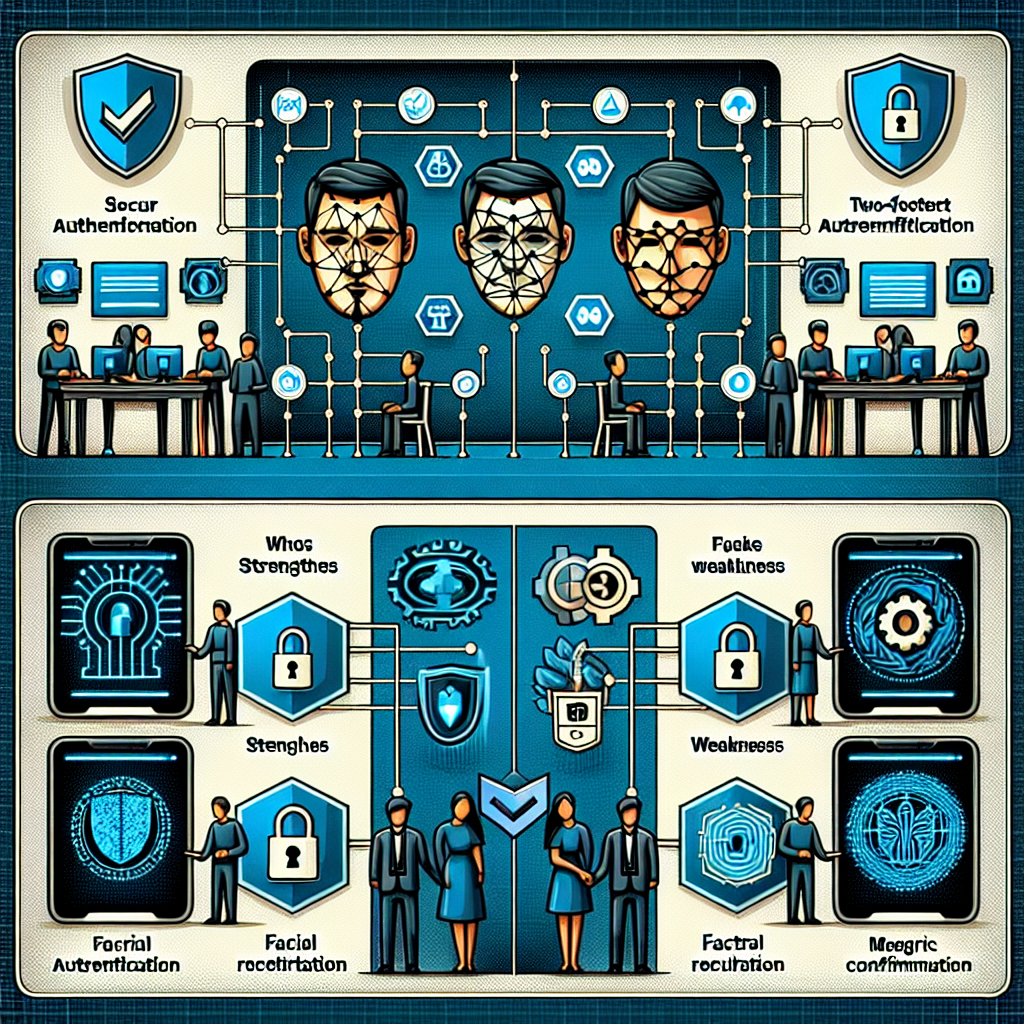

Before delving into comparisons, it’s essential to understand what makes a trading platform secure. Key aspects include encryption standards, two-factor authentication (2FA), compliance with financial regulations, data privacy policies, and the overall infrastructure designed to thwart unauthorized access and cyberattacks. A robust trading platform should prioritize these factors to safeguard users’ investments and personal details.

Encryption Standards

Encryption is the first line of defense in protecting user data. High-grade encryption, such as AES 256-bit, ensures that data is securely transmitted and stored, making it nearly impossible for hackers to decipher.

Platform A

Platform A utilizes AES 256-bit encryption for all data in transit and at rest, offering a high level of security for users’ personal information and transaction details.

Platform B

While Platform B also uses AES 256-bit encryption for data in transit, it employs a slightly less secure method for data at rest, potentially making it more vulnerable to sophisticated cyberattacks.

Two-Factor Authentication (2FA)

2FA adds an extra layer of security by requiring users to provide two different authentication factors to access their accounts, significantly reducing the risk of unauthorized access.

Platform A

Platform A offers 2FA via SMS and app-based authentication, allowing users to choose the most convenient or secure method according to their preferences.

Platform B

Unlike Platform A, Platform B mandates app-based 2FA, citing it as more secure than SMS, which can be vulnerable to SIM swapping attacks.

Regulatory Compliance and Audits

Adherence to financial regulations and undergoing regular security audits are critical for maintaining a secure trading environment. Regulatory compliance ensures that platforms operate within legal frameworks designed to protect investors.

Platform A

Platform A is fully compliant with major financial regulations, including the General Data Protection Regulation (GDPR) and undergoes annual security audits by independent third parties.

Platform B

While Platform B is compliant with local financial regulations, it has not yet committed to annual security audits, potentially leaving some vulnerabilities unaddressed.

Data Privacy Policies

A platform’s approach to data privacy is indicative of its commitment to user security. Transparent policies that limit data sharing with third parties are preferable.

Platform A

Platform A boasts a strict privacy policy, promising not to sell user data and only to share information with regulatory bodies when necessary.

Platform B

In contrast, Platform B’s privacy policy is less clear about the conditions under which it might share user data, raising concerns about potential data misuse.

Conclusion

Comparing trading platforms based on their security features is imperative in today’s digital age. While both Platform A and Platform B offer high-grade encryption, differences in their approaches to 2FA, regulatory compliance, and data privacy policies highlight the importance of thorough evaluation. Users should prioritize platforms that not only meet but exceed security standards, ensuring the safest possible environment for their financial transactions.

Ultimately, the choice of a trading platform should align with users’ security preferences, regulatory requirements, and the type of assets they intend to trade. With cyber threats evolving, choosing a platform that continuously updates and strengthens its security measures is crucial for safeguarding digital assets.