# Algorithmic Trading with Technical Indicators

Algorithmic trading has transformed the landscape of the financial markets, enabling high-speed, strategic trading decisions that can maximize profits and minimize losses. Technical indicators serve as the backbone of many algorithmic trading strategies, providing quantifiable data that can be leveraged to make predictions about future market movements. In this article, we’ll dive into how algorithmic trading harnesses technical indicators, spotlighting popular indicators and offering insights into building a basic algorithmic trading strategy.

Understanding Algorithmic Trading

Algorithmic trading involves the use of computer programs to execute trades based on predefined criteria. These criteria can range from basic price fluctuations to complex mathematical models that take into account various market factors. The primary advantage of algorithmic trading is its ability to process vast amounts of data and execute trades at speeds and volumes unmatched by human traders. This method reduces the impact of emotions on trading decisions, increases the accuracy of trades, and enhances the potential for profit in volatile markets.

Role of Technical Indicators in Algorithmic Trading

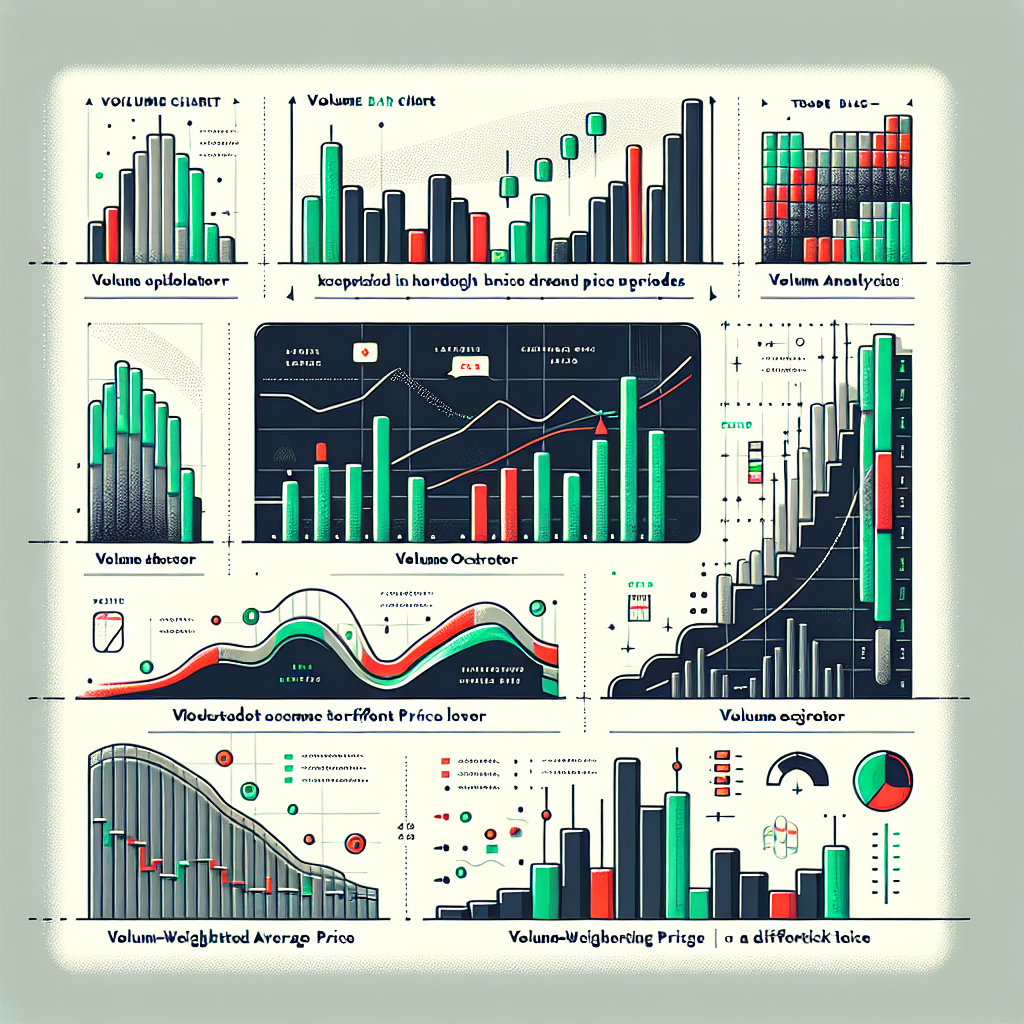

Technical indicators are statistical calculations based on historical market data such as price and volume. They are used to predict future market behavior and are integral to the development of algorithmic trading strategies. By analyzing patterns in the data, algorithms can identify potential entry and exit points for trades, helping to automate the trading process and make it more efficient.

Popular Technical Indicators for Algorithmic Trading

Moving Averages (MA)

One of the most widely used indicators, moving averages smooth out price data to identify trends. The two most common types are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). Algorithms might use these indicators to buy when the price moves above a moving average or sell when it falls below.

Relative Strength Index (RSI)

The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. It is typically used in an algorithmic strategy to signal potential reversal points by identifying situations where an asset is overbought (thus potentially peaking) or oversold (and potentially bottoming).

MACD (Moving Average Convergence Divergence)

This momentum indicator shows the relationship between two moving averages of a security’s price. Algorithms can use MACD to trigger trades based on crossovers of these averages, signaling potential bullish or bearish market movements.

Crafting a Simple Algorithmic Trading Strategy

Define Your Strategy

The first step in building an algorithmic trading strategy is to clearly outline what you want to achieve. This includes setting your investment goals, determining your risk tolerance, and identifying which markets you wish to trade.

Select Your Technical Indicators

Choose the technical indicators that align with your trading strategy. It’s crucial to understand how each indicator works and how it can be used to signal trading opportunities.

Backtesting

Before deploying your algorithm live, you must backtest it using historical data. This process helps you refine the strategy by simulating how it would have performed in the past. It’s also an essential step in identifying any flaws or adjustments that need to be made.

Implementation and Monitoring

Once you are satisfied with your strategy’s backtest results, you can begin implementing it in live markets. It’s important to continuously monitor the performance of your algorithm, making adjustments as necessary to adapt to changing market conditions.

Final Thoughts

Algorithmic trading with technical indicators enables traders to leverage market data for informed decision-making and strategic execution. By meticulously selecting indicators that align with your trading style and rigorously testing your strategy, you can enhance your trading performance in the dynamic world of financial markets. Remember, successful algorithmic trading requires continuous learning, adaptation, and discipline.