Introduction to Financial Independence through Investment

Achieving financial independence is a goal many aspire to, but not everyone knows how to reach. It’s the freedom to make life decisions without being overly stressed about the financial impact because you are prepared. You can achieve this through smart investment strategies that not only preserve your wealth but also make it grow. This article aims to provide valuable investment tips that could guide you towards financial independence.

Understanding Your Financial Goals

Before embarking on your investment journey, it’s crucial to have a clear understanding of your financial goals. These could range from retiring early, funding your children’s education, buying a home, or simply building wealth over time. Knowing your end goal helps in crafting a tailored investment strategy that aligns with your aspirations.

Setting Realistic Goals

Set specific, measurable, achievable, relevant, and time-bound (SMART) goals. For instance, saying “I want to have $1 million in retirement savings within 20 years” gives you a clear target to work towards.

Risk Tolerance Assessment

Understanding your risk tolerance is crucial. It influences the types of investments you should consider. While high-risk investments can offer greater returns, they also come with a chance of significant losses.

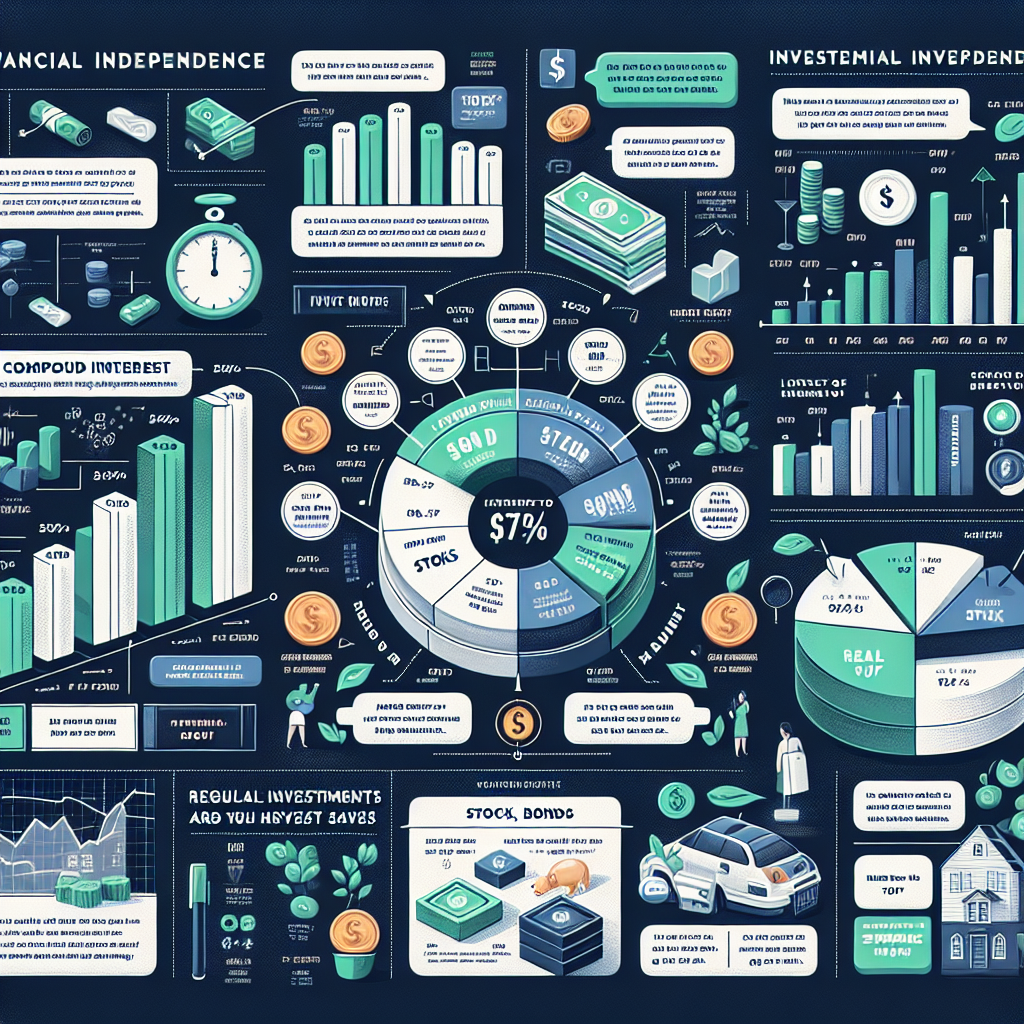

Essential Investment Tips for Financial Independence

Investing wisely is paramount to achieving financial independence. Here are some essential tips everyone should consider on their path to financial security.

Start Early

The power of compounding interest cannot be understated — the earlier you start investing, the more time your money has to grow. Even small amounts invested early can outgrow larger amounts invested later.

Diversify Your Investments

Don’t put all your eggs in one basket. A diversified portfolio can help you spread risk and has the potential to improve your overall returns. Investing in a mix of stocks, bonds, and other assets can help achieve this balance.

Make the Most of Retirement Accounts

Utilizing retirement accounts like 401(k)s and IRAs can offer tax advantages and are essential tools for saving for retirement. Many employers offer matching contributions to 401(k)s, which you should take full advantage of.

Understand What You’re Investing In

Investing in something you don’t comprehend is akin to navigating without a map. Before committing your money, ensure you understand how the investment works, the risks involved, and the potential for return.

Automate Your Investments

Consistency is key. Automating your investments can help in building your portfolio steadily over time. Direct monthly contributions from your paycheck into your investment accounts ensure you remain disciplined and can help smooth out the impact of market volatility.

Staying Informed and Adapting Your Strategy

The world of investing is ever-changing, and flexibility is crucial. Stay informed about financial news and trends, as these can affect your investments. Periodically review your investment strategy to ensure it aligns with your current financial situation and goals.

Continual Learning

Financial literacy is a lifelong journey. Continuously educate yourself on investment strategies, financial products, and market conditions. Knowledge is power, especially when it comes to investing.

Seek Professional Advice

If you’re unsure about your investment decisions or want to create a more sophisticated investment strategy, consider seeking the advice of a financial advisor. A professional can offer personalized advice tailored to your financial situation and goals.

Conclusion

Achieving financial independence through investment is a realistic goal with the right strategy, discipline, and knowledge. Start by understanding your financial goals, then implement the investment tips discussed, such as starting early, diversifying your portfolio, and staying informed. Remember, the journey to financial independence is a marathon, not a sprint. Patience, persistence, and smart investing will help you cross the finish line.